One important component of rising claims costs is the rising cost of hiring legal counsel. This is more controllable than often realized.

By April LeBlanc

Executive Claims Specialist, Professional Liability Claims

7-minute read

While much attention has been paid to social inflation and litigation funding, along with their contribution to rising insurance claim costs, another factor is the rapidly rising cost of legal defense itself—which is more substantial and controllable than is commonly realized.

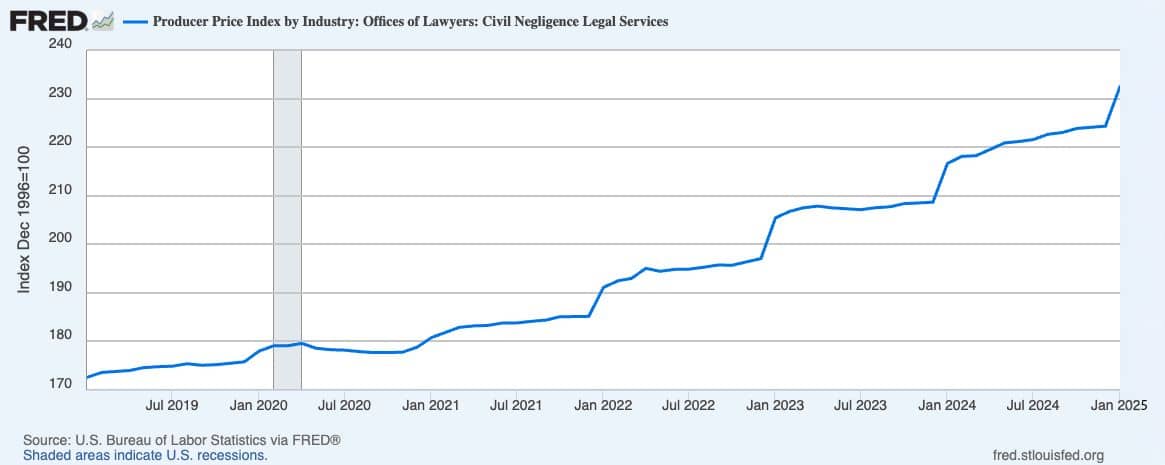

According to the Consumer Price Index, defense costs have risen much faster than the average inflation rate of 3.3% over the past 12 months. In fact, defense costs have increased roughly 30% since 20191 —harming profitability for both policyholders and insurers, as well as increasing the cost of insurance overall.

Litigation defense costs have increased 30% since 2019

In single-plaintiff legal malpractice and employment liability claims, it’s not unusual to see defense costs well in excess of $1 million, sometimes even approaching $10 million. In class actions, regulatory actions by government authorities and D&O matters, it is almost routine for defense costs to reach the low- to mid-eight figures, sometimes exhausting multiple layers of insurance coverage.

Admittedly, the cost of everything has gone up. Law firms’ expenses grew by double digits over the first three quarters of 2022, although expense growth decreased to 6% in Q4 2022.2 Increased litigation funding by third parties, an industry valued at $12.2 billion in 2021 that is expected to reach $25.8 billion by 2030,3 also adds to the increase in costs. This capital contributes to the growth in “nuclear verdicts” (currently defined at $10 million or more). It also enables plaintiffs’ attorneys to file more claims than in earlier decades, when lawyers needed to await either settlement or favorable jury verdicts in order to secure an infusion of cash.

A significant contributor to rising defense costs is the growth in attorney compensation.

Another significant contributor to rising defense costs is the growth in attorney compensation, which has increased on average by 30% since 2018.4

Hourly rates are growing more rapidly at large firms

Hourly rates at firms increased by 6% on average in 2023 and by another 6.5% through Q2 of 2024, as shown below.5 However, not all law firms’ rates are rising at the same pace. In particular, Thompson Reuters estimates that hourly rates for large firms increased by 7.8% in 2023 and 8.3% in the first half of 2024. Some sources estimate large firms’ rate increases were even higher, at 8.3% in 2023 and 9% through Q2 2024.6

Image used with permission of Thomson Reuters

To put these increases into perspective: the average hourly rate growth for attorneys between 2010 and 2022 was only 3.4% per year.7

There are additional reasons why large law firms may be raising their rates more quickly than others.8 For one, clients continue to pay the higher rates without pushback, leaving firms with no incentive to stop increasing their rates. In addition, like other businesses, law firms want to retain their top performers by offering more lucrative pay packages. The average annual compensation for a partner in a top 200 law firm is roughly $1.4M, a 26% increase since 2022.9 Many large firms have minimum billable hour quotas that must be met by their attorneys every year. Law firms also want to grow and attract talent from other firms to bring in more business—often, again, by offering more lucrative pay packages.10

Differing collection rates may also contribute to larger defense costs. Like many businesses, law firms had a harder time collecting overdue fees after COVID began, and often raised their hourly rates to compensate. While collection rates at most firms have returned to pre-pandemic levels, those rates are still low at the largest 100 law firms in the US, which may encourage further increases in hourly rates to compensate.11

Image used with permission of Thomson Reuters

Finally, legal industry rating systems may also contribute to rate differentials at larger law firms. The AM Law 100 determines a "top firm" solely by looking at financial performance; the higher the revenue and profitability, the higher the ranking.12 Thus, prominence on the AM Law 100 list can be heavily influenced by increasing rates and billing higher amounts.13

There are multiple ways to reduce defense costs

As multiple factors unrelated to quality cause law firms to increase their rates, there are multiple ways that growing defense costs can be constrained without necessarily impacting the quality of defense work. Here are several suggestions:

Develop a network of good lawyers, not expensive ones

Most liability insurers have already established multiple attorney networks, which include firms of all sizes across practice areas and jurisdictions. Network attorneys are asked to approach claims with a focus on resolution and often offer more practical or creative ideas for resolving cases. Policyholders can partner with insurers to select effective counsel with a successful track record.

Policyholders can partner with insurers to select effective counsel with a successful track record.

Negotiate reasonable rates

While past expectations may have been that hourly rates will be paid no matter how high they go, new expectations can always be set—particularly in cases where the client gives a lot of business to the firm. A policyholder and its insurer can discuss appropriate rates and attorneys before a policy is issued, thus minimizing later disagreements. Alternative fee arrangements, such as fixed fees or lower rates up front with incentives based on outcomes, are another way to curb costs. Insurers have developed an expertise in negotiating counsel fees and can help with these negotiations.

Perform due diligence to confirm that billing is reasonable

Legal invoices should be thoughtfully reviewed. There are vendors who perform excellent billing audit work, and many insurers have in-house resources that can assist with this task.

Don’t assume firm size and hourly rates equate to work quality

People often associate higher prices with higher value and automatically assume that the “budget version” of a product or service is of lower quality.14 Marketers discovered long ago, however, that once a service is perceived to have a high value, a price can be set that matches that perceived value instead of the product or service’s actual value.15

In short, not all good lawyers work for large, expensive firms. In fact, many boutique and mid-size law firms are staffed with experienced lawyers who previously worked at large firms but, due to the demands placed on them at some larger firms, decided to leave and now charge clients much more reasonable rates. Therefore, it’s often possible to retain top lawyers at much lower hourly rates than those charged by larger firms.

Taking advantage of this insight, and leveraging the best practices included above, can help curb both the growth in legal defense costs and the consequent rate increases for insurance itself.

- U.S. Bureau of Labor Statistics, Producer Price Index by Industry: Offices of Lawyers: Civil Negligence Legal Services [PCU5411105411103], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCU5411105411103, April 11, 2025.

- See The ABA Journal, “BigLaw associates ‘have never had it better;’ they are working fewer hours, survey says, and making more money,” Feb. 1, 2024, available at https://www.abajournal.com/news/article/biglaw-associates-have-never-had-it-better-they-are-working-fewer-hours-survey-says-and-making-more-money#:~:text=Strom%20looked%20at%20information%20provided,hours%2C%20Wells%20Fargo%20data%20show.

- See Globe Newswire, “Global Litigation Funding Investment Market Size Worth $25.8 Billion by 2030 at a 9% CAGR: Custom Market Insights,” Aug. 29, 2022, available at https://www.globenewswire.com/en/news-release/2022/08/29/2506137/0/en/Global-Litigation-Funding-Investment-Market-Size-Worth-25-8-Billion-by-2030-at-a-9-CAGR-Custom-Market-Insights.html.

- See The Wall Street Journal, “Rock-Star Law Firms Are Billing Up to $2,500 per Hour. Clients Are Indignant.” Oct. 4, 2024, available at https://www.wsj.com/business/rock-star-law-firms-are-billing-up-to-2-500-per-hour-clients-are-indignant-61b248c2.

- See Thomson Reuters, “Law firm rates in 2024: New report finds that rates continue strong growth, but could face shifting trends,” Sep. 17, 2024, available at https://www.thomsonreuters.com/en-us/posts/legal/law-firm-rates-report-2024.

- See The ABA Journal, id.

- See Thomson Reuters, “Law Firm Rates in 2024: The Bull, Bear & Base Case for rates and what it means for realization,” Oct. 17, 2024, available at https://www.thomsonreuters.com/en-us/posts/legal/law-firm-rates-bull-bear-base-case.

- See BTI Consulting Group, “Top 7 Trends in Litigation in 2025: More Complexity, More Spending on Outside Counsel,” Sep. 18, 2024, available at https://bticonsulting.com/themadclientist/top-7-trends-in-litigation-in-2025-more-complexity-more-spending-on-outside-counsel#:~:text=5%20areas%20of%20litigation%20show,these%205%20are%20standing%20out.

- See The Global Legal Post, “AmLaw 200 partner pay hits record $1.4m,” Oct. 25, 2024, available at https://www.globallegalpost.com/news/amlaw-200-partner-pay-hits-record-14m-1042659731, quoting recruitment firm, Major, Lindsey & Africa’s 2024 Partner Compensation Survey.

- See The Wall Street Journal, “Being a Law Firm Partner Was Once a Job for Life. That Culture Is All but Dead.” Aug. 9, 2019, available at https://www.wsj.com/articles/being-a-law-firm-partner-was-once-a-job-for-life-that-culture-is-all-but-dead-11565362437.

- See Thomson Reuters, Id.

- See The American Lawyer, “The 2024 Am Law 100,” Apr. 16, 2024, the rankings are available at https://www.law.com/americanlawyer/am-law-100.

- See The American Lawyer, id.

- See LinkedIn, “How does product pricing affect perceived value?,” Oct. 24, 2023, available at https://www.linkedin.com/advice/3/how-does-product-pricing-affect-perceived-value-drfaf. Also see global consultancy firm, Simon Kucher, “Value perception: Understand and enhance your products,” Jul. 5, 2024, available at https://www.simon-kucher.com/en/insights/value-perception-understand-and-enhance-your-products#:~:text=Price:%20While%20price%20is%20often,value%20proposition%20and%20customer%20expectations.

- Also see id.